Hello Friends, If you use a Xiaomi or MI phone, and you need a personal loan to complete personal tasks, you show canMI Credit App You can get instant personal loan through. In this article weHow to take loan from MI Credit Will learn about in detail.

If you want to take a loan through Mi Credit app, then in this article you will get answers to some important that questions related to Mi Credit. Like – how much loan will be available from MI Credit, required documents, eligibility, interest rate, loan tenure, charges and fees, etc.

Apart from this, you will know whether it is safe for you to take loan from MI Credit or not, so let us can know.How to take loan from Mi Credit?

What is MI Credit?

MI Credit, is a mobile loan application launched by Xiaomi to provide its customersinstant personal loan see Provides facility of. if youXiaomi If you are a customer ofMI Credit Through this, you can get a personal loan ranging from Rs 5 thousand to Rs 5 lakh at a low interest rate for a period of 3 months to 24 months.

Xiaomi is one of the best selling phone brands in India in the year 2018.MI Credit App Was started. Through was this app Xiaomi can provide its customersLoan Service Provides facility of. Till now more than 5 million people have downloaded this app. And the rating of this app is 4.3/5.

MI Credit is a Chinese company that provides loan facilities to its customers through its loan partners. Aditya Birla Finance, Creditvidya Finance, Early Salary, Moneyview, AndJestmoney Provided by.

Features of Mi Credit Loan

The main features of Mi Credit Loan are as follows.

- You can get loan can from Rs 5000 to Rs 5 lakh from MI Credit.

- The process of taking the loan is completely online.

- Less documents are required for the loan.

- You can get loan from MI Credit at lower interest rates.

- You can choose the repayment period of the loan amount according to your income.

- The approved loan all amount is transferred directly to your bank account.

- You can take loan from MI Credit without any physical paperwork.

Documents required to take loan from Mi Credit

Minimum documents are required for loan any from MI Credit. You must have the following documents before applying for the loan.

- identity card-PAN card

- Basic address proof- Aadhar Card, Voter ID Card, Passport, Driving License.

- Income Certificate –Salary slip and bank statement in which your salary is received.

- Photo- While taking loan one has to upload one’s own selfie.

MI CREDIT LOAN ELIGIBILITY CRITERIA

- citizenship- You must be an Indian citizen.

- Age limit- Must be above 21 years.

- bank account– 6 months bank statement in which your salary is received.

- Work-Must be self-employed or salaried.

How to download MI Credit App?

If you are a Xiaomi user then you can that easily download MI Credit App from MI Store. If you are facing any problem in downloading then you can download by following the steps given below.

- First of all open MI Store in the phone.

- After this type MI Credit and search.

- MI Credit App will appear in front of you, you have all to download it by clicking on the Install button.

- MI Credit App will be downloaded on your phone within some time.

In this way you can download Mi Credit app by following some easy steps.

How to take loan from MI Credit?

It is very easy for Xiaomi users to best take loan from MI Credit, to take the loan you should have some necessary documents mentioned above. If you meet the eligibility criteria of Mi Credit Loan, then you can get the loan by following the steps given below.

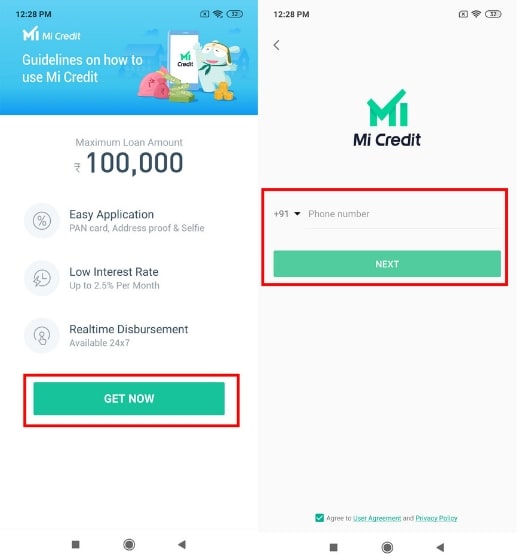

- First of all, download MI Credit App in your phone and open it.

- After this, accept the Terms & Conditions of MI Credit and tick the I Agree option and click on Continue.

- After this, Mi Credit will ask for some permissions, allow them.

- Now enter your 10 digit mobile number and click on Next button.

- After this, an OTP will come on your given number, enter it and verify. In this way your MI Credit Account will go to the bank.

- Now the home page will appear in how front of you, you have to click on the Get Now option.

- Now you have to choose the type of loan you want like- Personal Loan or Business Loan.

- If you choose a personal loan, then you have to choose the type of employee you are – like – if you do a job then you have to choose Salaried and if you are a professional then you have to choose Self-Employee.

- After this, a new page will open in front of you, in which you have to fill your basic details. As-

- Reason for taking loan

- loan amount

- Your PAN Card Number

- Gender

- Your name which is in your PAN card.

- Your date of birth which is in your PAN card.

- your monthly income

- Your mobile number, which is currently active.

- Email ID

- Post Pin Code of the place where you live.

- After filling all the information correctly, click on Continue option.

- Now to verify KYC, you have to upload KYC Documents PAN Card and Aadhar Card on MI Credit Loan App. Along with this, fill the details of the bank from which you want to receive the loan amount.

- After filling all the information, submit it, after this your loan application will go for review.

- If you are eligible for the loan, the loan amount will be transferred to your given bank account within some time.

In this way you can get a personal loan by you completing the MI Credit Loan Process given above.

What is the customer care number of Mi Credit?

If you have any question related to MI Credit Loan, then you can get answers to your questions by contacting that the contact details given below.